Cotton prices have been on the rise in recent weeks as a result of the government’s decision to enter the market, the strengthening of the dollar, which has made it less profitable to import cotton, and problems with quality and arrival shortages.

Seed cotton (Phutti) prices in Punjab and Sindh have surpassed Rs. 9,000 per 40 kg, while those in Balochistan have surpassed Rs. 10,000.

Prices for phutti currently range from Rs. 8,600 to Rs. 9,400 per 40kg in places like Bahwalnagar, Bahawalpur, Faisalabad, Toba Tek Singh, and Haroonabad.

Meanwhile, the peak rate has increased to Rs. 9,375 per 40kg in Rahim Yar Khan and Chichawatani. Seed cotton is already being traded in Balochistan for between Rs. 9,200 and Rs. 10,000 per 40 kg, especially in the Khuzdar area.

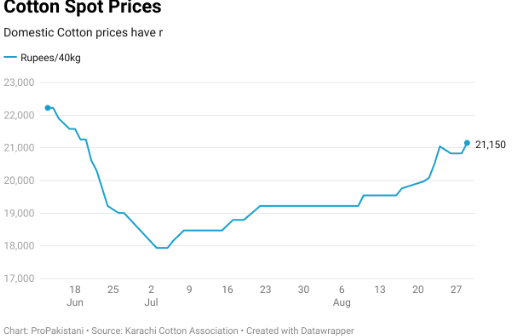

The prices on the Karachi Spot Market have also increased by 10% this month, peaking at Rs. 21,150 as of today after a few days of stability at Rs. 20,829.

While it is encouraging to see trade activity guaranteeing fair prices for cotton growers who were struggling to get even the support price of Rs. 8,500, a few buybacks from the textile industry also highlight the potential for future exports.

Additionally, the threat to the cotton crop in South Punjab posed by the Sutlej River flood, which has inundated more than 100,000 acres in Bahwalnagar alone, could also be a factor in the price increase.

According to media reports, the Sutlej flood situation is getting worse every day. More than 370,000 people have been evacuated, and India is expected to keep releasing water from the Bhakra and Pong reservoirs for a few more days, which could quickly spiral out of control.

So, the question of how long this rally will last still stands.

Awais Tariq from Neelum Corporation told ProPakistani that “bad news about the economy, rumours of the PKR/$ crossing Rs. 330, issues with opening LCs, and shortage from arrivals from fields to ginning are making the mills procure cotton.”

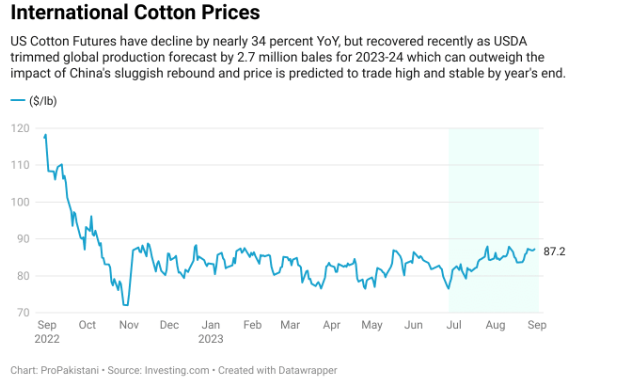

US Cotton Futures, on the other hand, have decreased by almost 34% YoY from $117 per pound a year ago, but they have recovered in the past month by about 14% from their low of $79 per pound on June 27th to $87 per pound at the moment, which is also encouraging domestic buyers to source cotton locally.

Prices have increased as a result of the United States Department of Agriculture (USDA) reducing the global production forecast for 2023–2024 by 2.7 million bales, which may have a greater impact than the effects of a slow recovery in China. In light of this, it is anticipated that, at the very least, by year’s end, international prices will be higher than they were the previous year.

The increase in crude prices, which is leading to an increase in shipping costs, is another factor that is making imported cotton less profitable for the textile industry. The traders who spoke to ProPakistani predicted that if the rupee depreciation continues, the price of seed cotton in Punjab could reach as high as Rs. 10,000 per 40kg.

According to Talha Qureshi, Cotton Procurement Manager at Siddiqsons Group, “The rise in cotton demand seems temporary due to the increase in USD and lack of arrivals, buyers are making panic buying” in a statement to ProPakistani.

According to him, it is not economically feasible for all businesses to stock cotton at this price level of Rs. 20,000 or more due to the high cost of production and interest rates. Eventually, the market will decline and settle between Rs. 18,500 and Rs. 19,00.

Since borrowing costs are at an all-time high and future increases in KIBOR are predicted, an increase in cotton prices will undoubtedly put spinning mills under pressure as a result of higher production costs. Farmers and ginsmen might profit if business is steady, but only mills with strong financial capabilities, low operating costs, and strong exports will survive.