Pakistan’s financial system had a positive development, with e-banking transactions accounting for 85% of total payments processed by banks and microfinance banks (MFBs). According to the most recent data from the State Bank of Pakistan (SBP), the remaining 15% were paper-based transactions.

In FY22, this figure was 80% for e-banking and 20% for paper-based transactions, demonstrating that clients are gradually shifting to digital channels. This tendency may also be a result of the post-COVID period, when many customers adapted to using digital channels to meet their day-to-day financial needs.

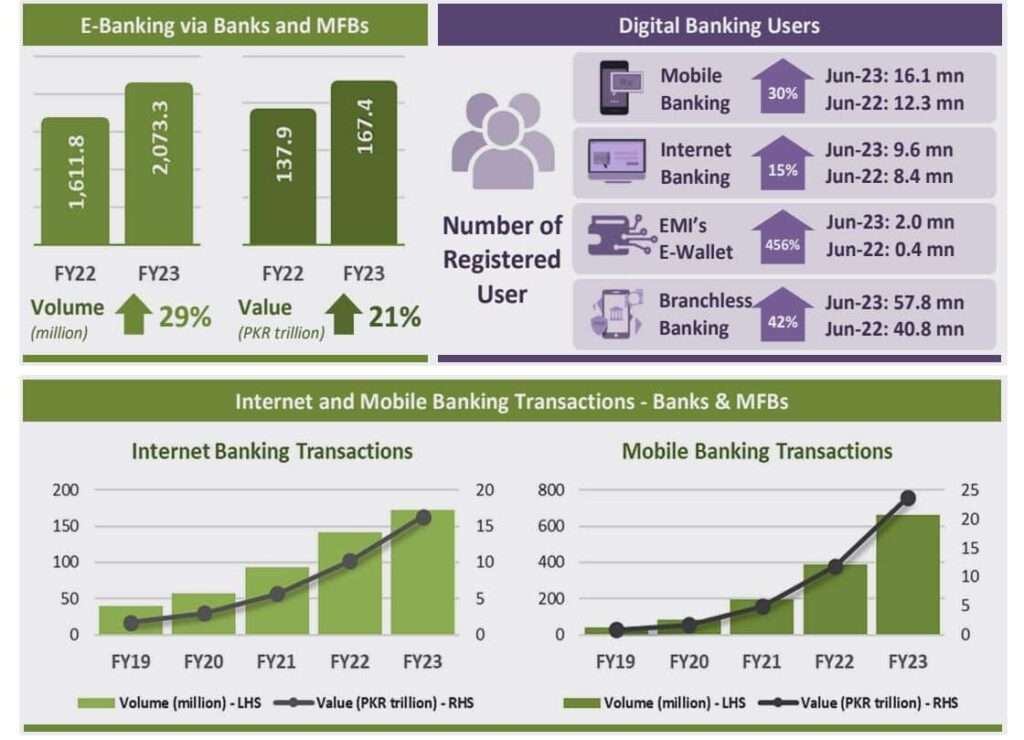

According to the SBP, banks and MFBs handled 2,073.3 million e-banking transactions worth Rs. 167.4 trillion during FY23, representing an annual YoY increase of 28.6% in volume and 21.4% in value.

Real-Time Online Banking transactions had the highest value share (68.1%) of all e-banking transactions, followed by Internet and Mobile Phone Banking combined (23.9%).

However, in terms of transactions, Internet and Mobile Phone Banking had the biggest proportion (40.1%) of e-banking transactions, followed by ATM-based transactions (39.1%).

Payment Cards and Online Banking

Payment cards increased by 24% year on year, reaching 58.1 million cards in circulation by the end of FY23.